Volume One

Ancient and Medieval States

Background

Early Banking

History

Banking has a long history, extending back to the agrarian empires of Mesopotamia. Commercial loans were made to merchants trading beyond the city state, and these attracted interest, probably compound interest for late settlements. The records of these loans, tablets sealed inside clay envelopes (bullae), could be sold to third parties. Unlike personal loans to farmers in difficulty, however, these commercially loans were not periodically annulled. Beyond these simple devices, however, there was no coinage as such, nor a need for one. Coins widely circulating would have weakened the bureaucracy by allowing private arrangements to evade or contest State control. {4} In general, lending seems to have been limited, at interest rates high by modern standards, and was only occasionally farmed out to powerful families. {1-5}

From 2000 to 209 BC at least, the temples and palaces in Babylonia were taking gold and silver deposits and issuing loans. Charges were high, up to one sixth of its value for gold deposited, and loans were typically for seed-grain, with repayment from the harvest. Again these services seemed to have been occasionally farmed out to powerful families, noted more for entrepreneurship than banking. {1}

Gold was deposited for temple safekeeping as early as the 18th century BC in pharaonic Egypt, to which were added large stores of grain, in temples and regional granaries. Both could be loaned, and so acted as a primitive banking service. Under the Ptolemies, these scattered government granaries were transformed into a network of grain banks, centralized in Alexandria, where detailed accounts were kept. The system thus operated as a government bank, which recorded payments between accounts without physically transferring grain or gold. {1-5}

Loans were probably made from the Vedic period (1750 BC) in India, and bills of exchange (adesha) were in use during the Maurya dynasty (321-185 BC). Buddhist temples subsequently made much use of these instruments, and also offered loans. Merchants in large towns exchanged letters of credit. {6}

Greek Banking and Coinage

Coins may have originated in Lydia and Ionia, but it was the Greeks who conceptualised money as the measure of all things, something different in nature from what it might represent. Money in the ancient Middle East did not go so far in its purposes, and did not use coins, though ingots and sealed purses circulated. But the Greeks were searching for new forms of government to manage polis life, and coins made that administration simpler and more manageable than primitive money like spits and cauldrons. {7}

Richard Seaford links the beginning of coinage to Greek animal sacrifice, and thus to the sanctuary, whose security allowed precious metal holdings to be distributed as payments for services. Precious metal in communal sacrifices guaranteed the value of coins, which was gradually replaced by the mark of the issuing city state. That mark signified an 'ideal substance which. . .belongs to a new kind of reality, concrete and visible (being metal) and yet (because distinct from the actual metal) abstract and invisible'. The mark was not originally a sign of quality, or quantity, but rather of redeemability: a socially or politically conferred value. The coin was accepted not merely for its intrinsic value but on trust. Money became the 'embodiment of the absolute abstract equivalence between commodities imposed by exchange' and therefore impersonal — unlimited in power, extent, and in the desire for it. Money united opposites, being both concrete and abstract: an idea that underwrites metaphysical principles of the Presocratics. {8}

In short, early Greek coinage had all the characteristics of money, namely:

1. The power to meet social obligations.

2. It was quantifiable,

3. It could provide a measure of value,

4. It was accepted, generally or for specific purposes,

5. It depended for its value on public trust, and

6. Involved the state in its issue, control of quality, and enforcing of its acceptability.

In contrast to their eastern neighbours, the Greeks saw the role of the god as not to demand food for himself and his household, but to require a human feast, whose vital political importance was the symbolic expression of communality, participation, or koinonia {9} (a view that supports of Hudson's view of Neolithic societies).

Greek city states offered extensive banking facilities to supplement their coinage, but the business was dominated by Athens, Corinth and Delos, where the bankers were often 'metics' or foreigners. Money changers and lenders operated near the temples and public buildings, setting up their trapezium-shaped tables decorated with lines and squares to aid ready calculation. The wide range of coins, generally of good quality but different weights made money-changers essential to trade. Deposits were also taken, no interest being paid on fixed deposits — coins, bullion and jewellery — because these did not enter into trade but simply stored in a safe place, generally in the temple treasuries. Interest was paid on current accounts, however, as these formed the funds for the lending business. States did not generally regulate interest rates, but 10% p.a. was thought reasonable for general business, and 20-30% for riskier ventures like shipping.

The pre-eminence of Athens, and her rich Laurion mines, allowed her to set the Attic silver standard, where the coins and units of account were: {10} 8 copper chalkoi = 1 silver obol: 6 oblos = 1 silver drachma: 2 drachmae = 1 silver stater.

Employed as units of account and weight only:

100 drachmae = 1 mina: 60 minae = 1 talent.

But each city state proudly struck its own coinage, and the eastern Greek standard was, for units of account and coins:

12 copper chalkoi = 1 silver obol: 6 oblos = 1 silver drachma: 3 drachmae = 1 silver stater.

Employed as units of account and weight only:

60 staters = 1 mina: 60 minae = 1 talent.

Neither the mina nor talent ever appeared as coins but, like the pound sterling throughout the Middle Ages, served simply as a unit of account. The coins ranged from gold pieces, worth 24 or 25 drachmae, through silver to small copper coins to tiny bits of silver, but obols and drachmae were the practical denominations. Pay for a labourer working at the Erechtheum temple on the Acropolis was 2 obols/day, for example, with the architect earning a drachma/day, i.e. three times as much. Most cities, and particularly Athens, strove to maintain the quality and reputation of their coinages. At the height of her power in 486 BC, Athens indeed forced Aegina to take the Athenian owls as her currency, and in 449 BC ordered that all foreign coins be handed in to the Athens mint for restriking. But as Athenian power declined, so other states began issuing their own coinage again. Mighty Athens was humbled further when Sparta cut her off from her Laurion silver supplies, and she had to melt down her statues on the Acropolis and mint 84,000 drachmae with the gold. Subsequently, when coin shortages worsened in 406-5 BC, Athens was forced to issue copper coins with a thin silver plating, a sorry situation that lasted till the reissue of proper silver drachmae in 393 BC. In 380 BC the Athenian citizens voted to create their golden Acropolis statues again, a task that took 50 years. {11}

Delos, a barren offshore island possessing only a magnificent harbour and famous temple of Apollo was the most serious challenge to Athenian banking. Detailed records of trade and banking stretch over 400 years, and show a shift from simple transactions in cash to credit receipts and payments being made into named accounts on receipt of written instructions. The larger deposits were kept in the temple of Apollo for safety, and sums could be impressive: e.g. 48,000 drachmae lay untouched for 20 years. Though they destroyed Carthage and Corinth for political reasons, the Romans preserved and supported Delos, in time using her operations as a model for their own banking system. {12}

Bullion gradually replaced grain as a medium of exchange in Greece and Asia Minor. Banking in Athens was on a cash basis, with gold treasuries in particular stored in temples, as throughout the archipelago. Athens imported her grain from outside, most notably from areas round the Black Sea, and prosecuted market manipulators. Long-term loans were needed for distant trading, and such loans could be traded as collateral. Indeed anything and everything could be pledged as collateral — slaves, mining rights, workshops and sometimes what had already been pledges. Athenian business was complex, but citizens, who in their hundreds judged cases in actions for compensation and sharp-practice, had a legal knowledge and business acumen that would be exceptional in today's societies. The trapezium kept the records, but business depended on personal relations, trust and the law. Short-term loans were often needed to cover the unexpected, and for 'liturgies', those public displays of wealth that upheld social and political position. {13}

Roman World

The early aes was replaced by a silver and copper coinage as the Romans came more into contact with the Greek world and needed currency to pay mercenary troops. The silver coinage of the Republic was very conservative, however, and simply displayed the head of Roma etc., allusions to various gods and goddesses, and initials of the issuing moneyer or magistrate. Julius Caesar was the first to issue a coinage bearing his own portrait, and Augustus expanded the practice, striking a splendid series of denominations, which served until the denarius was replaced by the antoninianus in the third century. The Augustan aureus was worth 25 denarii, 100 sesterterces, 200 dupondii and 400 asses. Diocletian reformed the heavily-debased coinage in 301-5. A gold solidus was now set at 10 argenteus, 40 nummus, 200 radiate coins, 500 laureate coins and 1000 denarius. In the late empire (337-476) the solidus was set at 12 miliarense, 24 siliqua, 180 follis and 7200 nummus. {14}

As to be expected of that practical people, banking was further developed on Greek lines, but expanded to include many of the instruments of European banking, notably public debt, treasury bailouts and tax farming. Rome was an oligarchy, ruled by a small, self-perpetuating number of individuals defined by wealth and heredity. Wealth bought power, and was indeed made a pre-requisite. On pain of demotion, senators had to be worth 250,000 denarii, and equestrians 100,000 denarii. The equestrians made their wealth in commerce, often spreading their risk by buying shares in a wide range of businesses (publicas) Senatorial wealth was expected to come from the farming of large estates, but in practice both classes indulged in commerce, lending money on an enormous scale, and promoting the ubiquitous trade necessary to the empire. Share ownership indeed allowed power struggles to be fought with financial rather than military instruments. {15}

Certainly there were periodic crises. The most serious came in the Second Punic War, where Rome's treasury came near to extinction. Rome borrowed heavily from Syracuse, and then defaulted. Rome had to beg loans from wealthy citizens in 210 BC, and sell off Campanian state property in 205 BC, but all was made good by Hannibal's defeat in 202 BC, when the rich Carthaginian gold and silver mines of Iberia fell into Roman hands, and imperial expansion could be funded again. A second crisis arose in 123 BC, when the tribune Gaius Gracchus shifted judicial oversight of governors from the Senate to the equestrian class, who were often shareholders (publicani) in every aspect of business life. Another came with the Senate requirement in 33 AD that loans be three-quarters secured by land in Italy. Loans dried up, and ruin to many followed. Tiberius on his death had to leave 2.7 billion sesterces to bail out the system. Trajan had also to instigate tax forgiveness in 101 AD to help the smaller, hard-pressed Italian farmer. But banking remained important and lucrative to the end, and here the wealthy classes had recourse to a chain of intermediaries, in which a vital link was the slave, whose liability (peculium) could not be transferred to the slave's owner. Slavery was endemic to Roman life, and many slaves were well educated, more than capable of managing complex businesses. By such intermediaries, even emperors could keep their hands clean of sordid matters like lending, and able to enrich themselves knowing that their investment was protected, with only an individual slave's peculium being at risk. No doubt the slave managers received a share of the profits. {15}

Coinage is inconvenient for larger transactions, and much of Roman business employed virtual money — essential for the investment and long-distance trade that kept the empire together. Roman business was in fact extraordinarily sophisticated, being enabled and controlled by complex legislation. Business was generally conducted through partnerships (societas), which were of limited duration, and automatically dissolved on the death of partners. Tax collection, provisioning of troops and public works were conducted through societies (publicas), however, legal entities existing independently of the individuals involved. As with the peculium, liabilities were limited to the shares in the publicas owned by defaulting parties, and did not extend to the assets of publicas itself. {15}

Bankers are less conspicuous in the historical record of the later empire, and — if not simply driven underground — lending may have suffered from the 12% cap placed on interest in the third century. It was in this period (from 235 AD) that coinage also suffered its worst debasement, probably because Rome was cut off from its usual supplies of metal, by the Goths in northern Europe and the Berbers in Iberia. Mining activities are in fact documented by Greenland ice core records. Atmospheric lead contamination peaked around 143 BC and again in 36 AD. Isotope ratios show that 70% of the contamination came from the RioTinto mines of Iberia, with the Cartegena mines making a significant contribution later. Lead contamination levels fall to a low in 473 AD, and do not reach Roman levels again until 1200. {15}

Coins did not wholly disappear from western Europe after the fall of the Roman empire, however — England alone had large issues of small Anglo-Saxon sceats, and then more substantial pieces partly modelled on Islamic silver coins — and even in the 'Dark Ages', when coinage was not widely used for trade, the denominations stayed alive as measures of value. Charlemagne (768-814) imposed a money of account based on the old Roman system of pounds (libra), shillings (solidi) and pence (denarii). {16}

Islamic World

Trade was essential to the Islamic world, which developed many of the services seen later in China and the west. Operating from the eight century onwards, and independent of the state, were bills of exchange, partnership (mufawada), including limited partnerships (mudaraba), cheques, promissory notes, trusts, transactional accounts, loans, ledgers and assignments. Business was conducted more through partnerships than loans, and usury was acceptable only in specific instances — on government loans, for example, or when based on paper or base metals rather than the ubiquitous gold dinar. {17}

Banks were commercial enterprises, but also strictly adhered to Islamic principles, generally risk-sharing more than the risk-transferring that underlies western banking approaches. All had their names and legislation — mudharabah (profit sharing), wadiah (safekeeping), musharakah (joint venture), murabahah (cost plus), and ijar (leasing) — and these have been studied in recent years by countries wishing to avoid predatory western practices. {18}

Imperial China

Cowries were probably used as currency from earliest times and are found as grave goods in the pre-Bronze Age burials of central China. Cowries paid for salaries and the casting of bronze vessels in early Zhou times, and these cowries — whose importation from areas where they are plentiful was controlled or prohibited — were later replaced by bone and bronze imitations. The 'shell' pictogram is found in Chinese words for treasure, wealth, collateral, possession and the like. That bronze may be significant because Shang bronze vessels were used in ritual intermediations between the natural and spirit worlds. China was monetised early in its history, and conflicts in the Period of the Warring States were generally for material gain. Commoners made their money in this difficult period by forging weapons and farming implements, by trading with barbarians, by selling slaves and foodstuffs, by robbing graves, by lending and by casting spade and knife coins. States also issued vouchers for salt and army provisions. Loans could be for small amounts over short periods but often attracted high rates of interest. {19}

Bar fractional reserve banking, consumer services and a national debt, Imperial China was offering all major banking services by the time of the Song Dynasty (960-1279) — including deposits, loans, currency exchange, long-distance remittances, and paper currency (Sichuan in 1024). Banking was primarily commercial in nature, however, authenticated by close family ties, and the working capital was based on short-term money transfer rather than long-term demand deposits. By Qing times the system had developed into two institutions, which largely cooperated with each other. The piaohao, or Shanxi banks, facilitated large cash transfers between branches, and operated as single proprietaries or partnerships, whose owners carried unlimited liability. The qianzhuang were a network of smaller banks that issued notes, and also offered local money exchange and various commercial services. Fractional reserve banking and consumer banking were introduced by western traders in the nineteenth century. {20}

The Knights Templar

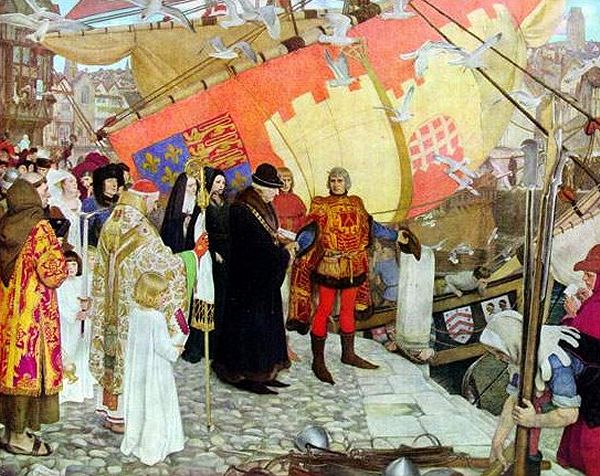

Originally set up to fund Christian armies in the Holy Land, and to protect local pilgrims on their dangerous journeys, the Knights Templar became in the course of two centuries an international financial institution stretching from western Europe to the Crusader kingdoms on the eastern extremities of the Mediterranean. The knights themselves took a vow of poverty, but the order nonetheless became so wealthy that its assets were eventually seized by royal debtors and rival mendicant orders. {21}

The Templars offered a range of services unsupplied by others in feudal Europe. They provided secure depositories for royal treasuries and jewels, arranged loans to needy monarchs, and supplied merchants and pilgrims with letters of credit in countries where travel was hazardous. The Templars also acted as trusts, overseeing bequests, the fair settlement of estates and selling of life annuities. For these vital services in feudal Europe they were well rewarded in grants, properties and estates. Indeed the kings of Aragon promised them a fifth of the booty and property gained in their Moorish wars, plus bailiwicks, i.e. the right to collect dues and taxes on towns and royal estates. Such arrangements in effect monetised the feudal system. By providing immediate loans, which sovereigns needed for war, the Templars obtained cash flows for long years into the future. {21}

Honor de Bazacle

Some financial practices of the Middle Ages were more home-grown. Flourmills on the Garonne at Toulouse, for example, operated on capitalist principles from 1372, when twelve amalgamated into the Honor de Bazacle, a company lasting till nationalisation in 1946. Up to sixty mills had previously competed for prime locations, but Honor de Bazacle issued shares in a company protected by civil charter from interference by Church and State. Just as today, the shares (uchaux) were traded, at prices that reflected expected returns. {22}

Need the 22 references? Please consider the modestly-priced ebook.