Volume Two

Modern States

European Community

Behind the euro-zone lies the intention, stated as early as 1950, to make war between the member countries not only unlikely, but materially impossible. With important but tacit USA support, France, West Germany, Belgium, Luxembourg and Italy formed a European Coal and Steel Community in 1951, and these countries formalized a free market, and free movement of peoples in the 1957 Treaty of Rome. Before the Maastricht Treaty of 1993, the community was known as the European Economic Community (EEC), the Common Market or the European Community (EC). In 1987 came the Single European Act, and in the 2007 Lisbon Act, after which the community was simply called the European Union (EU). {1}

History

The 1993 Maastricht Treaty paved the way for a common currency, the euro, which was introduced in 1999 and arrived fully armed with notes and coinage in 2002. Though dire warnings were issued to sceptics, not all countries voted yes to the required referendum, and some were denied a referendum at all. Ideally, it was thought, a common currency area would require: {1}

1. Flexible labor markets, with mobility to prevent local skills shortages.

2. Responsible product and financial markets, with competition, innovation and entrepreneurship.

3. Integration of labor, services and capital.

4. Diversity, so as not to be over-reliant on small market sectors.

5. Strong government, with common goals.

6. Similar inflation rates.

7. An emphasis on growth.

The specific rules for euro-zone membership were:

1. Budget deficit should be below 3% of GDP.

2. Total public debt should not exceed 60% of GDP.

3. Members should have an inflation rate within 1.5% of the three EU countries with the lowest rates.

4. Long-term interest rates should be within 2% of the three EU countries with the lowest rates.

5. Exchange rates should be kept within a specified 'normal fluctuation' margin.

In fact, member states failed to bring their economies into line (convergence) but were admitted nonetheless, political agendas overriding economic criteria. Situations were deliberately fudged, particularly in Portugal and Greece. The latter kept public sector liability off the balance sheet, had a highly inflexible labour force (public officials were next to impossible to fire) and used a $1 billion credit from Goldman Sachs (at expensive rates) to misrepresent matters. {1}

Government

The EU has various institutions to ensure democracy and smooth running: {1}

European Council, where the government of each country is represented by one minister. It holds legislative and executive powers, and is the main decision-making body of the Community.

European Commission, where each country has one representative expected to represent the community interests: the executive arm, drafting Community law, and dealing with its day-to-day affairs. European Parliament at Strasbourg, to which members are elected, seats being allocated according to the population of member states. Though EU MPs vote according to political allegiances, and often represent a wider spread of opinion than is possible with national governments, electorates still see the European Parliament as bureaucratic, petty-minded and distant from their affairs European Court of Justice, whose decisions can overrule national courts. European Court of Auditors, which ensures that taxpayer funds are correctly spent. European Central Bank (ECB), which administers the monetary policy of the euro-zone countries. Price stability and low inflation are its primary aims. {1}

By 2007, the EU trade area was the largest in the world, accounting in 2010 for 40% of international trade. Trade in services had nearly doubled between 1993 and 2002, and trade in manufactures had risen in the same period from €670 billion to well over €1,000 billion. Until recently, inflation was kept below 2% p.a., and its currency was more stable than the British pound. Social mobility has been less than hoped, however, and many states remained strongly nationalistic. {2}

Threat: Sovereign Debt Crisis

Many factors contribute to a situation where some countries in the euro-zone now have difficulties in servicing their government debt.

Recession

When Governments across the world were forced to bail out their banks, and banks themselves cut back on lending, economies went into recession. Unemployment rose, tax revenues diminished, and welfare and infrastructure projects had to be pruned, adding further to unemployment and electorate dissatisfaction with their governments. Countries typically borrow in these circumstances through bank loans and government bonds, but found it costly to do so because the rates increased sharply to cover the risk of default. The loans required were large, moreover, and investors saw better opportunities in China, India and Russia. Devaluation was not possible because countries were locked into a common currency employed by member states with different economies, problems and aspirations. {3}

Inequalities

Many euro-zone members ran large budget deficits. That of Greece continued to widen throughout 2011, growing to €20.52 bn in the first 11 months of that year. Ireland's widened from €18.7 bn in 2010 to €24.9 bn in 2011. In contrast, some countries ran trade surpluses. The value of German exports was $1.334 tn in 2010, second only to China's (twice that of the UK, and some 60 times that of Greece). Imbalances vary with the country concerned, but many showed a decrease until the 1980s and an increase thereafter. {4}

A common currency rewards the more efficient countries. The labour cost of output increased by only 5.8% for 2000-09 period in Germany, for example, but rose in Ireland, Spain, Greece and Italy by some 30%. {5}

Outside trade by member states also varied widely. The largest surplus was achieved by Germany (+ €45.0 bn in January-March 2012), followed by the Netherlands (+€11.8 billion) and Ireland (+€10.3 billion. The UK registered the largest deficit (-€37.1 bn), followed by France (-€21.6 bn) and Spain (-€10.7 bn). The deficit has to be funded by banks and financial institutions, with German banks indeed holding $250 bn of troubled euro-zone member bonds. {6}

Corruption

The banking crisis left Ireland, Portugal and Spain much at risk, but the main threat of default came from Greece. {2} The country had not brought its financial measures into line with core euro-zone members, but retained its 'clientelism', where inward investment is diverted by politicians to buy votes from important interest groups, a legacy from Ottoman days and later. The country suffered a civil war immediately after W.W.II (1946-9), a mass migration from the countryside, and then the 1976-74 backward-looking, repressive military dictatorship, which did not improve public accountability. Corruption affects all levels of government and business (the country came 71st out of 180 in the 2009 Corruptions Index ranking.) Restrictive practices are rampant. The tax system is byzantine, with the authorities hounding the honest few and leaving higher-earners untouched. (Less than 5,000 of an estimated 60,000 households currently declare annual incomes over €100,000.) In contravention of EEC rules, heavy subsidies were pledged in 2009 to cotton (€75 million) and wheat producers (€100 million), €75 million being made immediately available. In 2011, more than a million Greeks paid a bribe for better service in the public sector. Hospitals are notably inefficient. Scandals are commonplace. Four Greek pension funds were implicated in a JP Morgan scam involving €280 million of Greek government bonds in 2007, and money laundering in the 2007 Siemens case, which led Switzerland to freeze €200 million in bank accounts. {7}

In short, Greece is a low-tax, low public-service country papered over by EU cohesion funds, bond market borrowings and omerta from its better-off inhabitants. {26} Notably lacking are those features Michael Porter termed 'advanced' — skilled labour, natural resources and infrastructure sufficient to compete in given industry sectors. Demand is fuelled by overseas borrowing. Supporting industries are not internationally competitive, and businesses generally lack the structures of euro-zone core counterparts. Nonetheless, Greece was accepted into the European single currency in 2001, and three years later hosted the Olympic games. For ten years, Greece enjoyed a prosperity founded on tourism, shipping, agriculture and real estate. Northern European banks and institutions gave loans because Greece was importing their manufactures, helping to depress local prices and so lower the apparent inflation. Greek textile companies indeed moved to Bulgaria and Turkey, while Greek households splashed out in cars and holiday homes. In 2008 GDP growth was still 2%/year, but the following year it reversed to -2%. Public debt was then 115.1% of GDP, and the trade balance was 12.0% of GDP. Matters are seen very differently by the Greeks themselves and others, who accept that corruption and tax evasion has to stop, but also blame the predatory nature of the financial institutions and US foreign policies. {8}

Banks

Though many banks put quick profits (casino mentality) above the funding of sound business and public welfare projects, the pattern shows wide geographic variations. Debts levels are higher in the US and UK, their citizens being more addicted to credit cards than are Germans or even the French. Banks and hedge funds have benefited from uncertainty in the currency markets, some of it created by their actions. Much is held off the balance sheets, though the sums are large (US$ 13-22 trillion) and are complexly interconnected. British and American banks are variously exposed to loans taken out by troubled European countries. {9}

Bond Markets

Companies raise capital by taking out a loan, and/or by issuing shares and bonds. Bonds run for a set period of time at a stated interest rate. Upon maturity the loan (bond principal) is returned. Interest is usually paid every six months. Bonds are also issued by municipalities, states and (most importantly) by sovereign governments. Bonds are traded. If a $1 bond yielding 1.5% interest is sold at 80 cents, reflecting doubts on its future value, the interest is effectively $1.5/0.8 or 1.875%, the acquirer being rewarded with an increased yield for accepting a higher risk. Many factors enter into risk assessment (interest rates, maturity of the obligation, credit risk, liquidity, embedded options; and tax treatment of the obligation). Spreads are the differences between two stated prices or other variables, and provide a measure of market concerns. In money markets, for example, the TED spread, a difference between T-bill and Eurodollar rates, compares the difference between a 'risk free' Treasury rate and a comparable commercial rate. Spreads between Libor (rate at which banks lend money to each other) for different currencies also indicate their relative strengths, and may determine forward exchange rates. {10}

Very large sums are involved. The 2010 OECD forecast indicated that US $16 trillion would be raised in government bonds among its 30 member countries, and that financing needs for the eurozone would total €1.6 trillion (compared to US$1.7 trillion of Treasury bills and securities, and ¥s 213 trillion of government bonds in Japan). {11}

The 2008 crash worsened the debt situation in countries like Greece, Portugal and Spain, and automatically increased their costs of borrowing through the bond markets — and thus the danger of default. With that danger came increased costs of borrowing, and so more danger of default, a clearly dangerous spiral. Business commentators regard the costs as regrettable, but simply as the way the bond market works, and indeed must work. Socialist commentators see financial institutions as loan-sharks, i.e. purposely ensnaring countries in heavy debts that can only be paid by austerity measures and the sale of government assets at knock-down prices. {12}

Credit Rating Agencies

Some have questioned the impartiality of credit agencies. From being too lax in grading the junk bonds that helped create the financial crisis, the agencies have swung to being more severe with governments, downgrading many of them from AAA status and so making loans more costly. Moody's downgrading of Portugal's foreign debt to the category Ba2 'junk', was strongly criticized, as was Standard & Poor's lowering of France's rating below that of the UK, which had more deficits, as much debt, more inflation, and less growth. Germany accused S&P of playing international politics. {13}

Media

Greek and Spanish governments have criticized the English press, believing that the euro is under attack so that the UK and the US can continue funding their large deficits with loans and bond purchases by China. {14}

Politics

Political considerations have sometimes overridden economic matters, and countries have later admitted they were not wholly suitable members, the convergence data being obligingly fudged. Greece and Portugal kept their public debt off the books, and in both Greece and Italy the gross governments debt has exceeded 60% of GDP for long periods (as indeed has Germany's at times). {15}

Labour

Countries vary greatly in educational standards and training of their workforces, as in the proportion working in public services (the latter high in Greece and France). Labour has been much less mobile than expected, and some trades unions (e.g. in Greece) have negotiated unsustainable pensions and expansions in the public sector. {16}

Private Debt

Fortunes were lost when the property boom collapsed (Spain, Ireland, UK), and losses transferred to banks, which then had to be bailed out or taken over with taxpayers' money. {17}

Proposed Remedies

Many remedies are being proposed, some practical and immediate, others utopian.

Austerity

Lenders exacted policy changes, usually a speedy reduction in debt so that outstanding obligations could be met. Many countries therefore found themselves trapped in the vicious spiral of austerity. Falling tax receipts required countries to cut back on welfare and public services, which only further reduced employment and tax revenues. Countries rife in corruption, tax evasion and financial misrepresentation (e.g. Greece on all three counts) found loans were only granted on strict conditions (usually more austerity) and at punitive levels of interest, making default even more likely. Generally it was the public service and lower-paid staff, and not the parties responsible, that bore the brunt of austerity measures, which only increased hostility to banks, politicians and further integration with Europe. {18}

European Financial Stability Facility (EFSF)

Finance ministers on 9 May 2010 agreed a €750 bn rescue package aimed at ensuring financial stability across Europe. {19}

Debt write-off

In February 2012, the eurozone leaders agreed a 53.5% write-off of Greek debt owed to private creditors. They also increased the EFSF to €1 trillion, and required capitalization in European banks to reach 9%. {20}

European Central Bank

The ECB began open market buying operations in 2010. A year later, the Bank loaned €489 billion to 523 commercial banks for three years at a rate of one percent: Long Term Refinancing Operations (LTROs). In June 2012, the Bank was considering underwriting the government bonds of member states, creating a single supervisor to oversee the euro zone's banks, and allow the creation of mutual bonds that would reduce borrowing costs for member states. {21}

European Financial Stabilisation Mechanism

Created in January 2011, the EFSM is an emergency funding program reliant on financial markets but which uses the EU budget as collateral. This Commission fund, backed by all 27 European Union members, has the authority to raise up to €60 billion, and is rated AAA by the credit rating agencies. It will be replaced by the permanent rescue funding program (ESM), and was used to bail out Ireland and Portugal. {22}

Closer Economic and Political Integration

Such integration would solve many problems but also increase the power of corporations and financial institutions. Most electorates are opposed to further losses in national identity and political accountability. {23}

Banking Reform

Many argue for large banks to be broken up, and investment (casino) activities to be separated from high street banking facilities. Banking supports the US political process, however, and Britain has impeded European reform to protect her large banking industry. {24}

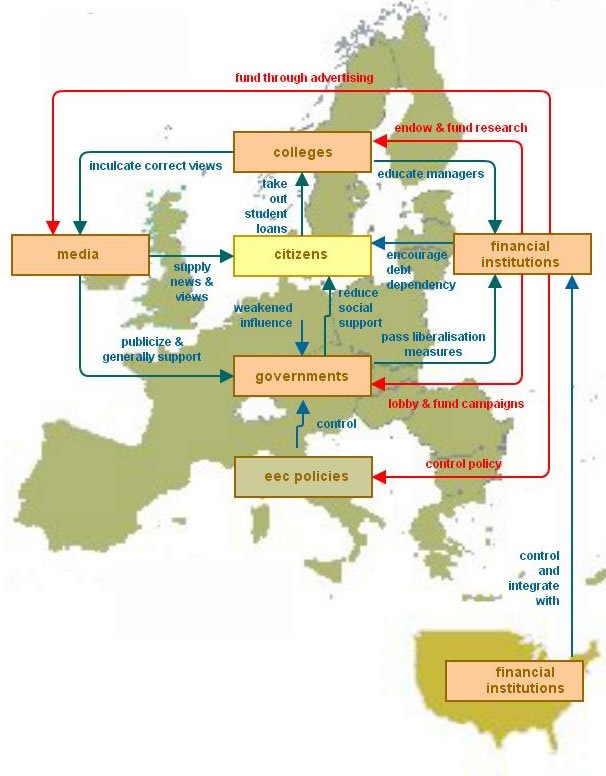

Electoral Reform

Critics assert that governments do not consult the great mass of their citizens but rely on media propaganda, misrepresentation and voter apathy to create self-perpetuating oligarchies that share power between themselves. Moves to remove money from politics have widespread support, except and critically from those currently enjoying power. Reform will no doubt come, but probably slowly if European history is any guide. {25}

Independent Banking Authority

Michael Hudson has called for the establishment of an independent financial authority to asses what Greece can reasonably pay and how — similar to that which suspended German reparations and Inter-Ally debts in 1931. {26}

Outlook

The EEC was a worthy project that has been successful on both political and economic fronts. It secured peace, created the world's largest trading block and brought prosperity to millions of its citizens.

Its current problems are widely recognized: {27}

1. The project was rushed, leaving wide discrepancies between member states without the means to correct them.

2. The true standing of member states has been obfuscated, and figures kept off the balance sheet.

3. Flaws have been exploited for private gain by politicians, banks and trades unions.

4. Goods manufactured in northern Europe could be purchased by poorer southern Europe only with large loans: which gradually built up to dangerous proportions.

The current austerity measures do not get to the heart of the problem, and are self-defeating: depressed economies do not yield the tax receipts to repay loans, and citizens will not accept such measures unless reform is also brought to political and financial institutions, which as yet acknowledge little need for change.

The EEC is also seen as undemocratic, passing measures without debate that benefit corporations and foreign governments against the majority wishes of its citizens.

Britain has voted for exit. Greece will probably have to leave the euro-zone eventually, possibly Portugal and Spain too. Other member states will remain, suffering austerity but having their government bonds underwritten by the European Central Bank and some emergency fund or insurance to cover bank default. {28}

Model

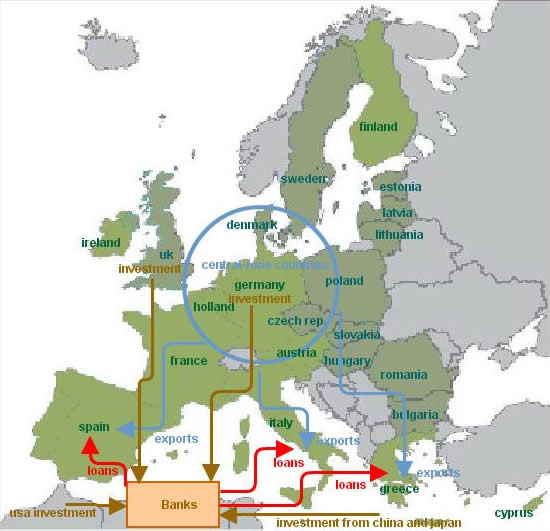

The EEC is export-orientated. The trade surpluses of the central EEC members (notably Germany's Bundesbank) were invested in property etc. in periphery members countries (Greece, Spain, Portugal) and in financial products sold by US banks. When German banks learnt they were contaminated with toxic assets they pulled in their assets to protect lending ratios, with serious repercussions. Investments in Spain, for example, amounted to €200 m. or 10% of GDP, and capital flight plunged the country into serious debt. Cut-backs in public services and bank loans led to recession.

Banking is a fraternity and, rather than change the rules and let the EEC Central Bank act as lender of last resort, the 'Troika' (the European Commission, European Central Bank, and International Monetary Fund) called for austerity, only granting bailout packages on that basis, and providing funds that were not to stimulate the economy but pay back existing loans. The Central Bank could have offered soft loans directly to the countries concerned, for example, but instead provided loans at under 1% to the major banks, which then offered loans to the countries concerned at much higher rates. Rates above 5% make loans difficult to repay, prompting more negative ratings, yet higher interest rates, and so more likelihood of default. The central banks are therefore strengthening their position, and indeed insisting that austerity — lowering salaries, cutting public services, and reducing social protection — also be a requirement of countries raising money on the bond markets, certainly if those bonds are to be underwritten by the European Central Bank. The remedies lie with even-handed political action, but neither the European nor the national parliaments are viewed with much confidence or esteem by electorates. {29}

Banking is a fraternity and, rather than change the rules and let the EEC Central Bank act as lender of last resort, the 'Troika' (the European Commission, European Central Bank, and International Monetary Fund) called for austerity, only granting bailout packages on that basis, and providing funds that were not to stimulate the economy but pay back existing loans. The Central Bank could have offered soft loans directly to the countries concerned, for example, but instead provided loans at under 1% to the major banks, which then offered loans to the countries concerned at much higher rates. Rates above 5% make loans difficult to repay, prompting more negative ratings, yet higher interest rates, and so more likelihood of default. The central banks are therefore strengthening their position, and indeed insisting that austerity — lowering salaries, cutting public services, and reducing social protection — also be a requirement of countries raising money on the bond markets, certainly if those bonds are to be underwritten by the European Central Bank. The remedies lie with even-handed political action, but neither the European nor the national parliaments are viewed with much confidence or esteem by electorates. {29}

Alternative Models

Left wing critics believe austerity is being imposed on Europe to weaken social structures and create a pool of lower-paid labour, a strategy that benefits the IFIs and large corporations. Shrinking the economy is therefore intentional — 8% overall since 2009, and unemployment over 25% in Spain and Portugal, and nearer 50% among their young — because citizens will moderate their wage claims and governments become increasingly dependent on banks to balance their fiscal shortfalls. Europe is arguably suffering the early liberalisation problems that afflicted India and Brazil, and facing the spectre of stagnation and 'a lost generation'. More than a third of the population is at risk of poverty or social exclusion in Bulgaria, Romania, Greece, Latvia and Hungary. Protests are widely reported, but have not changed government policies unnecessarily beholden to financial institutions. The need is not for less banking, therefore, but greater empowerment of borrowers through opportunities to invest and retain control of their money — all of which the EEC has paradoxically made more difficult. {32}

Left wing critics believe austerity is being imposed on Europe to weaken social structures and create a pool of lower-paid labour, a strategy that benefits the IFIs and large corporations. Shrinking the economy is therefore intentional — 8% overall since 2009, and unemployment over 25% in Spain and Portugal, and nearer 50% among their young — because citizens will moderate their wage claims and governments become increasingly dependent on banks to balance their fiscal shortfalls. Europe is arguably suffering the early liberalisation problems that afflicted India and Brazil, and facing the spectre of stagnation and 'a lost generation'. More than a third of the population is at risk of poverty or social exclusion in Bulgaria, Romania, Greece, Latvia and Hungary. Protests are widely reported, but have not changed government policies unnecessarily beholden to financial institutions. The need is not for less banking, therefore, but greater empowerment of borrowers through opportunities to invest and retain control of their money — all of which the EEC has paradoxically made more difficult. {32}

Government by Committee

Contrary to dreams of universal peace under one government, the situation of EEC countries shows what difficulties a monolithic financial control can impose. Modern governments need to raise enormous loans to run their economies, and those loans are subject to the confidence and goodwill of the international banking community, which levies charges at each stage of the process. Countries have the sovereign right to issue their own currency, of course, on terms of their own making, but the strength of the American dollar and the danger of capital flight are generally held to make such undertakings hazardous. Yet Germany effectively did so under the Nazis, and China retains control of the renminbi, to the disgust the industrialized west that is guilty of similar sharp practice: where China subsidizes production, America prints money. {33}

EU member support for US policies in the Middle East (which have created a severe migrant problem throughout Europe) and Neoliberal thinking (i.e. austerity and reduced job prospects) were the key factors behind 2016 Britain’s decision to leave the community. Against the better interests of its citizens, the EU has also adopted confrontational American policies to isolate Russia, suffering counter-sanctions that have hurt both parties. Indeed, far from representing the constituent countries and their peoples, EU politicians are closer to Washington and corporate lobbyists, which is perhaps why electorates are relunctant to devolve further powers to a European superstate. {34}

Some see the EEC as an unworkable compromise between federation and sovereign state, without the overall advantages of either. Private debt is altogether ignored, though this largely controls the economy, higher levels of private credit coinciding with lower unemployment levels. Total demand in an economy is the sum of the turnover of existing money plus credits, the latter being created one-for-one when banks create new debt, and something normally spent almost immediately by the debtor on assets or goods and services. But the EEC rules prevent compensatory mechanisms. Germany, for example, able to pay down both government and private debt because it deliberately undershot the agreed 2% overall inflation rate, gradually built a commanding lead over other OEDC countries, on which it then imposed deflationary austerity measures, crippling in Spain and Italy, and devastating in Greece. As in the recent moves to prevent Catalonia independence, overt force may be increasingly needed to hold the E.E.C. together: economic and probably military force. {35}

2018 Update

The gulf between the progressive north and the uncompetitive south continues to widen. The last financial crisis was triggered by sharply escalating interest rates on the government bonds of the EU's southern members: Greece, Cyprus, Italy, Spain and Portugal, plus Ireland. Threatened default was avoided by implementing a series of financial support mechanisms: the European Financial Stability Fund and the European Stability Mechanism, with the European Central Bank also lowering interest rates by buying government bonds and private debt, and providing low interest loans of more than one trillion euros to the banking sector. Some 50% of Greek loans were written off, but the country is still insolvent. Further adjustments and Grexit are both problematic. The 'bail-in' of Cyprus banks has been written into law. Impending disaster with non-performing loans in Italy, which exceed US $600 bn., has been averted by creating a $ 4.7 bn back-up fund and by allowing banks to package non-performing loans into asset backed bonds carrying a government guarantee so they can be sold off to investors. {36}

The Target 2 system, by which the strong surplus economies of Germany and northern Europe are transferring hundreds of billions of Euros to subsidize the deficit countries of Italy, Spain and southern Europe is unsustainable. One solution would be to split the euro into two currencies: a soft euro for southern Europe and a hard euro for its richer northern members. The soft euro would trade at a discount to the hard euro, providing some measure of devaluation. {36}

Migrant flow is an under-reported problem, and terrorist threats are increasing. {36}

Brexit has descended into farce, with options promised the electorate being denied by Brussels, and the referendum itself brought into question by spending irregularities and voter manipulation. {36}

References and Further Reading

Need the 85 references and 3 illustration sources? Please consider the inexpensive ebook.